What is debt filtration?

Debt Filtration is the science of eliminating debts legally and permanently, without payment. That’s right, I said eliminating your debts without payment, LEGALLY AND PERMANENTLY!!!!! Our program includes Debt Filtration. Our Debt Filtration Program combines 50 different Debt Cancelation Laws, Debt Forgiveness Programs, Hardship Programs, and Fresh Start Programs into one easy to use program. Never heard of debt filtration before. Do not worry, you are not alone. Debt filtration is a closely guarded industry secret. Most companies only understand one or two of these complex systems. Never before has anyone put all of these programs under one roof. By combining these programs, it is actually possible to eliminate up to 90% of your bad debt without payment using Cancelation and Forgiveness. Don’t be shocked by this. America is in the debt forgiveness business. Remember the bailout of the S&L’s, the Mortgage Industry, the Auto Manufactures, the Insurance Industry, and the list goes on. Well, we are pleased to announce that the government offers Americans a bailout as well. The only problem is no one ever takes advantage of the bailouts because they do not even know they exist. And even if they knew they existed they don’t know how to use them. Why does America cancel debts? Three reasons (1) our forefathers came from debt oppressive societies. They came from societies with debtor prisons; you could lose your hands or even be killed for bad debt. When they came to America, they wanted change; they created a system that allowed Americans an opportunity to get in and out of debt very quickly. (2) capitalism only works when citizens spend money, primarily on houses and cars. If your debts stop you from making major purchases, then the system breaks down (3) this country was founded on biblical principles. Debt filtration is in the Bible. “A certain creditor had two debtors: one owed five hundred denarii, and the other fifty. When they could not pay, he canceled the debts for both of them.” (Luke 7: 41-42) and secondly, 1″At the end of every seven years you shall grant a remission of debts. 2″This is the manner of remission: every creditor shall release what he has loaned to his neighbor; he shall not exact it of his neighbor and his brother, because the LORD’S remission has been proclaimed.…Deuteronomy 15:2.

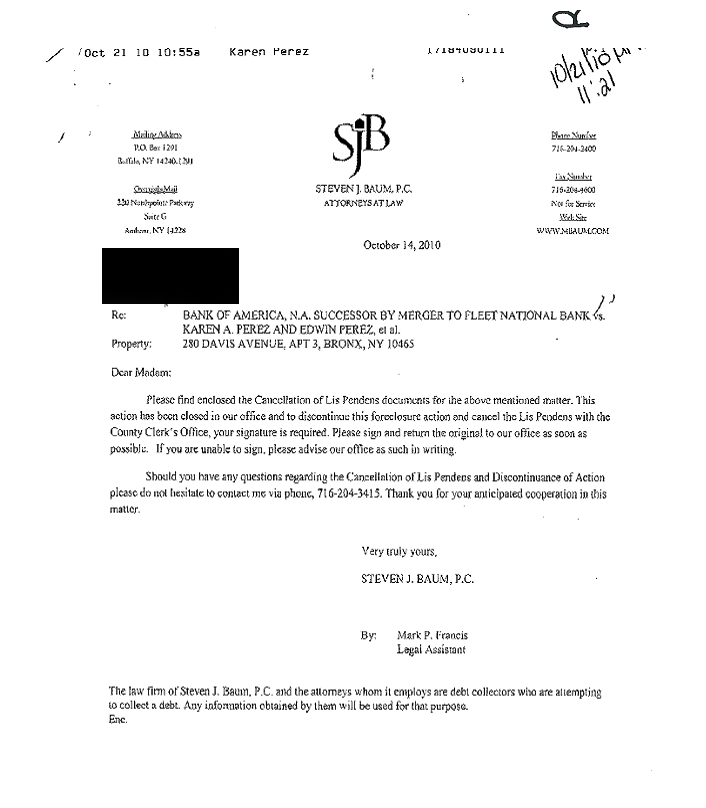

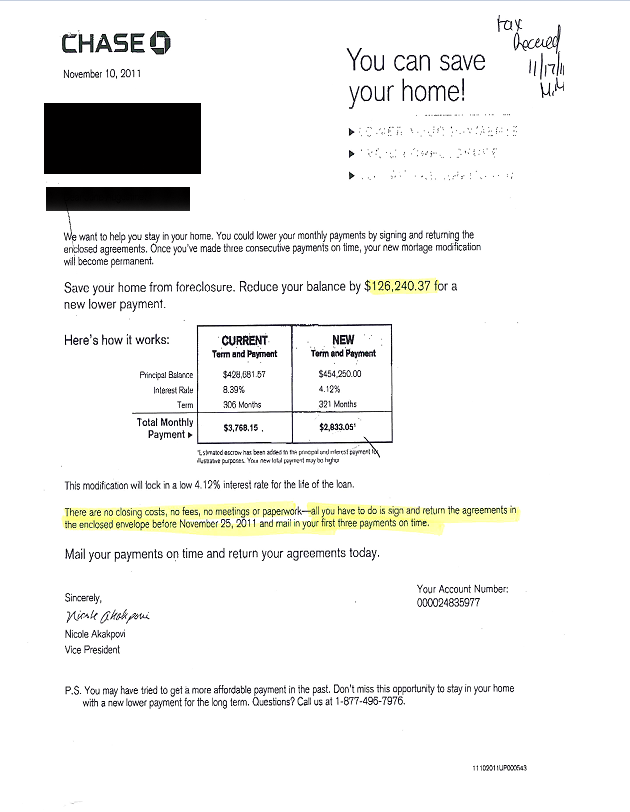

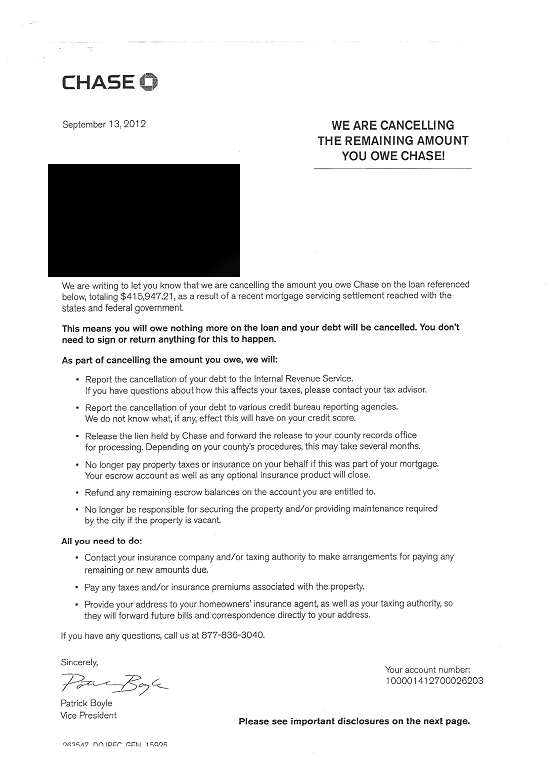

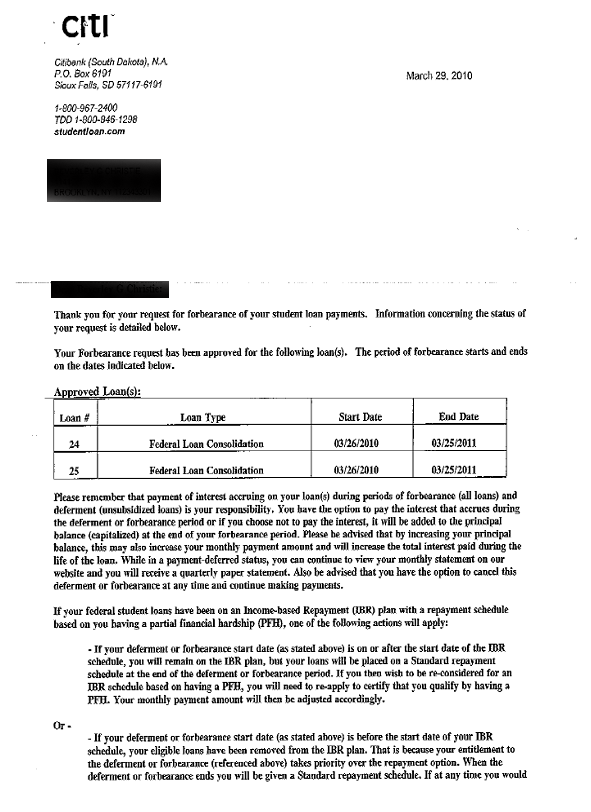

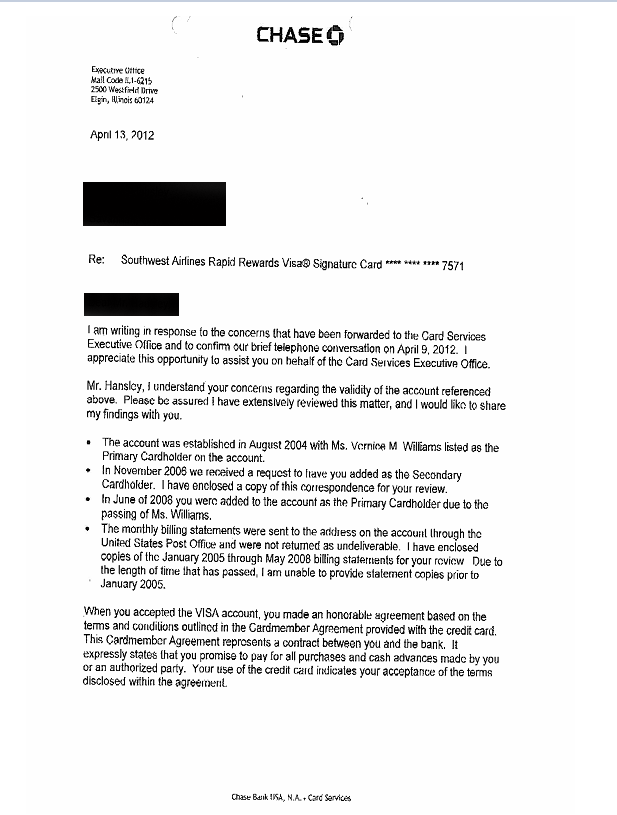

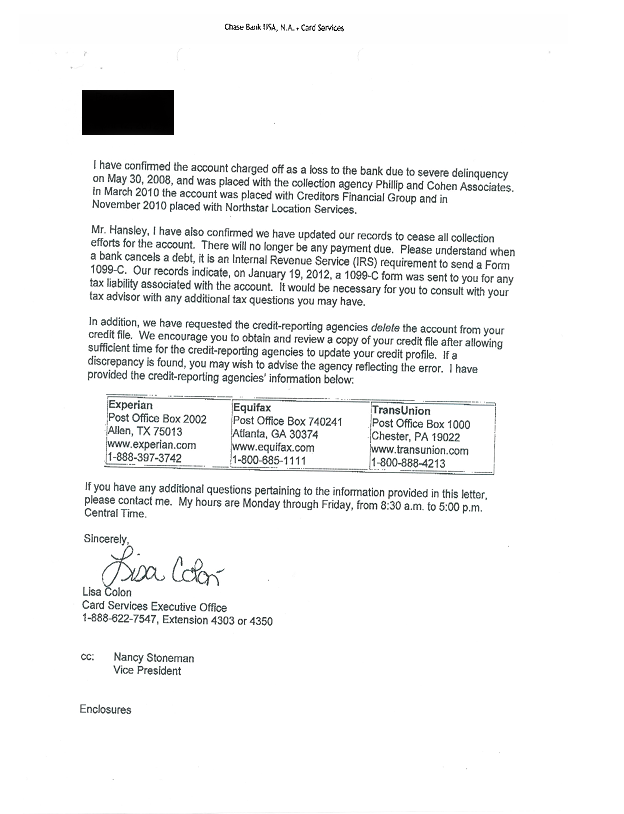

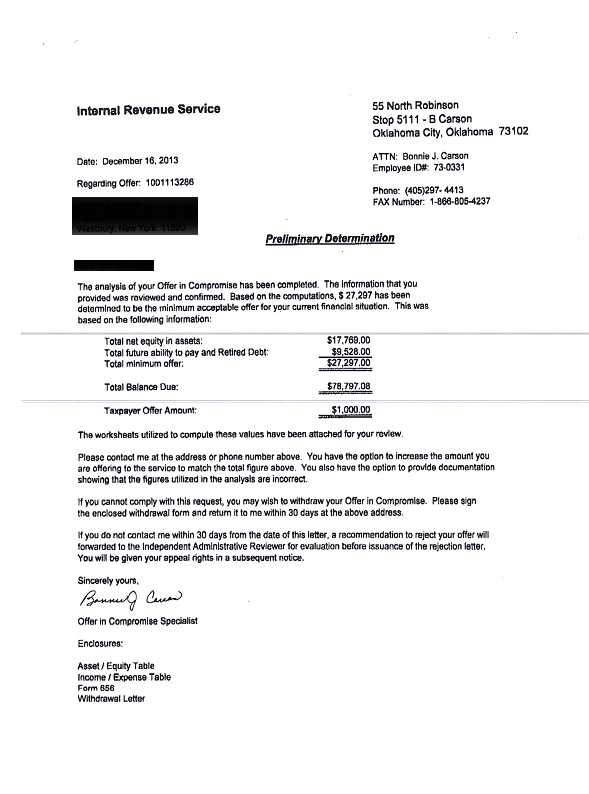

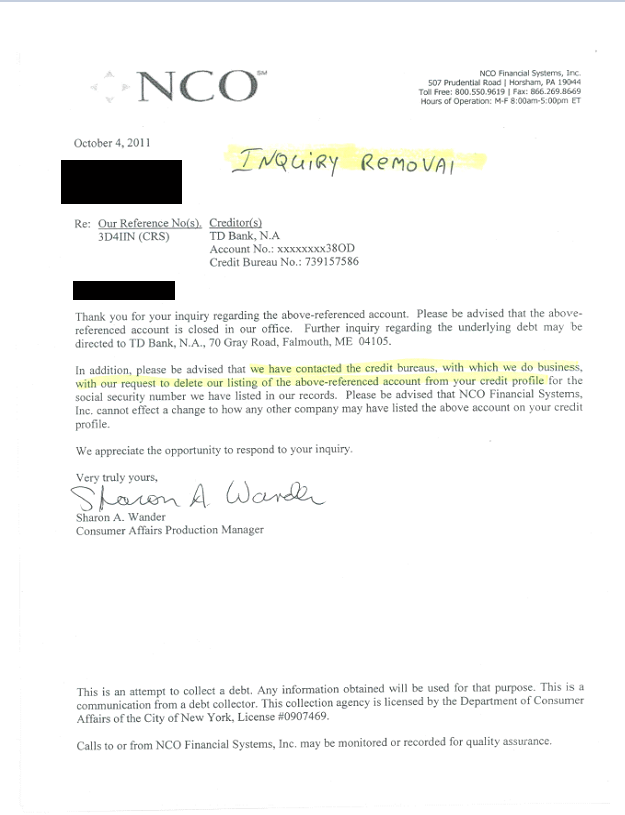

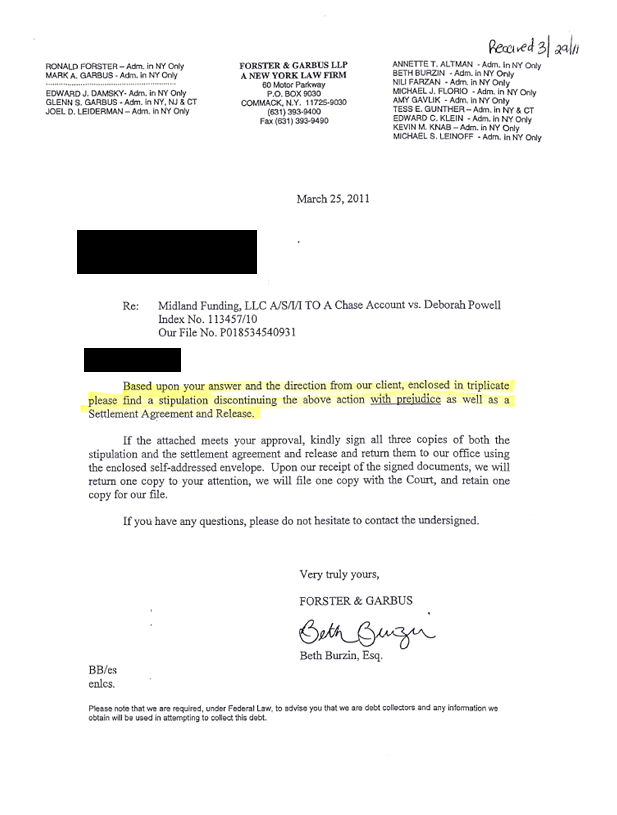

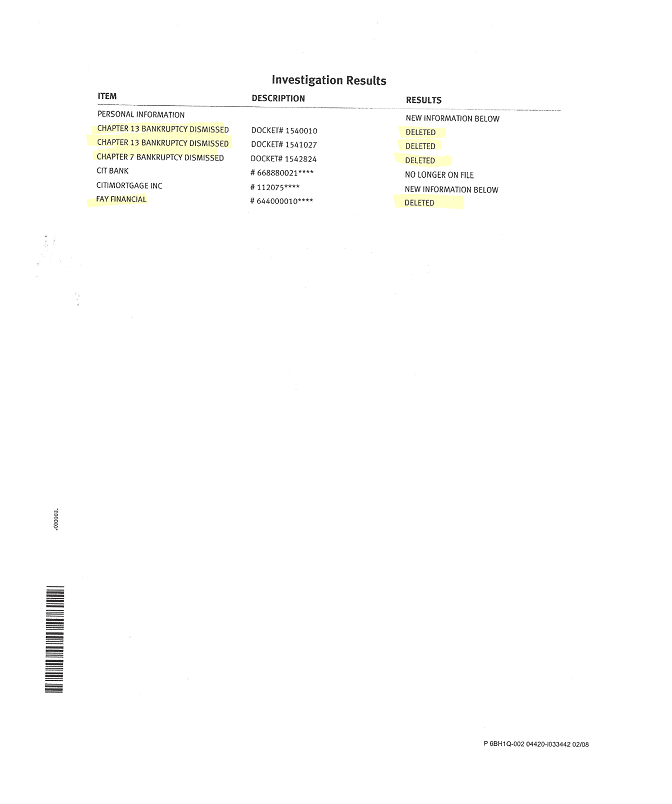

The bottom line is that you should never file for bankruptcy, consumer credit counseling or debt consolidation. Or even if you were really brainwashed and you had to file for one of those then do yourself a favor and filter the debts first. At least if you reduced your debts 90% first then you would have a lot less to file for bankruptcy. Try this the next time you talk to your bankruptcy attorney and ask him about debt filtration. Here are some examples of how to handle common problems using debt filtration, unlike credit repair we force the creditors to walk away from the debt and fix your credit at the same time. Remember for every bad debt that you have in America there is a corresponding debt filter to eliminate that debt, even tax liens, foreclosures, student loans and judgments.