How to remove bankruptcy from your credit

Bankruptcy is one of the hardest items to remove from your credit, but it is possible given the right methodology. The bankruptcy removal tool should only be used by professionals. If you file bankruptcy, please ask your bankruptcy attorney to use the bankruptcy removal tool, otherwise bankruptcy filings will destroy your credit. Most people wrongly believe that bankruptcy is a debt filter, but it is not. The reason that you know that it isn’t is because it violates the rule of all debt filters. It doesn’t improve your credit. Because of debt filtration you should almost never file bankruptcy 7 and never file chapter 13. The Fair Debt Collections Practices Act states that, “§ 802. Congressional findings and declaration of purpose:

“(a) There is abundant evidence of the use of abusive, deceptive, and unfair debt collection practices by many debt collectors. Abusive debt collection practices contribute to the number of personal bankruptcies, to marital instability, to the loss of jobs, and to invasions of individual privacy.”

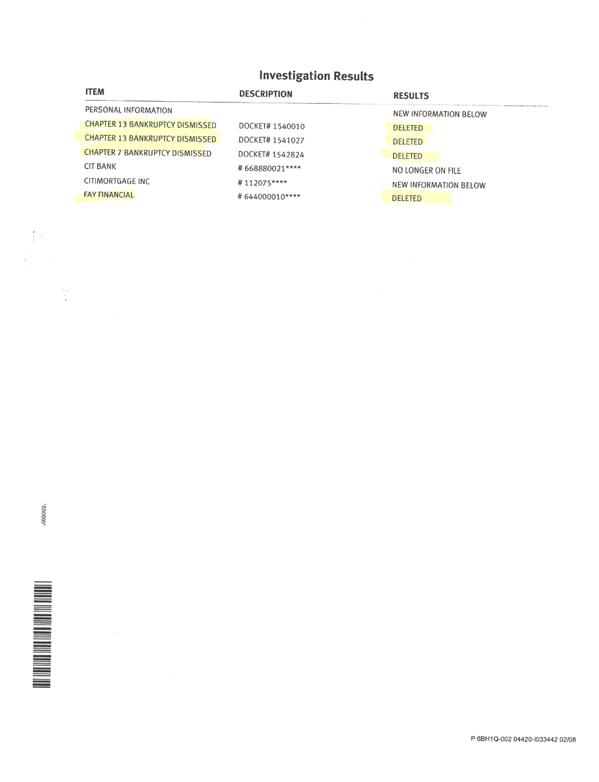

Unfortunately, a lot of law firms are really debt collectors, so this statement includes them. What Congress is trying to tell you is that you are filing bankruptcy for debt that you don’t really have to pay because the government has already given you a debt filter to get rid of these bad debts (Cancelation and Forgiveness remember). The reason that your attorney probably recommended bankruptcy is because they did not study credit and debt law in law school. In fact, very little attention is spent on these subjects. The reason is because it is considered to be a bad business model by lawyers to focus on a client base that is broke and has bad credit. So to your disservice most attorneys recommend bankruptcy because it is easy to file and is very lucrative for them and your “purported creditors”. See example.